Questionaire

- Hits: 131

Projects with IQX are not just fair-weather projects. Whether in production development, series ramp-up or as a project manager, we usually lead difficult and complex projects to success with the help of consulting, project management and interim management. Through efficient resource planning, consistent performance, scheduling and resource management and through transparent reporting, we have already managed many complex, challenging projects. In this way, start-up management is strengthened by establishing the right process organizations, through consistent decision management and through the early integration of employees into production and work organizations. The monetary assessment of risks and opportunities as well as the creation of risk and opportunity fluctuations are also part of our claims management tasks. Successful project management requires discipline, responsibility and commitment. Projects can only be made successful through disciplinary adherence to the tools provided, through full assumption of project responsibility and through high commitment in many project phases.

Read more ... project management

The takeover and integration into your own business world or merger of a company should fundamentally be a worthwhile business for the takeover. However, at the same time it is a very complex and challenging undertaking. While successful mergers and acquisitions (M&A) can result in significant growth and competitive advantages (which are often no longer achievable through generic growth), the process itself is fraught with significant potential pitfalls.

IQX GROUP has an exclusive pool of experts and former executives who can use their experience to effectively address the key challenges companies face during acquisitions and mergers.

your contact

At IQX, our focus in an M&A project is not only on the transaction itself, but above all on the future design of the operations. The long-term success of an M&A depends largely on how well the operational processes work after the integration.

We recognize that it is not enough to simply bring two companies together legally and financially - the real challenge lies in creating synergies and making operational processes efficient. We therefore analyze the existing structures of both parties at an early stage and develop solutions that ensure that daily business activities continue to run seamlessly after the takeover. Our goal is not only to realize short-term efficiency gains, but also to lay a stable foundation for sustainable growth and successful transformation.

Through our expertise in operational integration, we create a clear roadmap that ensures long-term value creation, minimizes risks and at the same time opens up opportunities for innovation and efficiency. In this way, we ensure that the M&A brings the greatest possible success not only today, but also in the future.

One of the biggest hurdles in any merger is the integration of different corporate cultures. Different leadership styles, values and expectations of employees can lead to conflicts and reduced work morale.

The IQX GROUP carries out a thorough cultural assessment during the due diligence phase. Together with the potential transferee and the potential transferee, we develop a comprehensive integration plan that includes strategies for cultural alignment, team building activities and consistent communication. This makes it possible to clearly identify - expected - gaps in cultural integration before the acquisition, to have plans available and to close them after the acquisition has been completed.

Inadequate due diligence can lead to unforeseen liabilities, overvaluations and missed red flags that can jeopardize the success of the deal.

We see it as extremely important to use a multidisciplinary team of experts in due diligence that includes financial, legal, operational and cultural (change) experts. In addition to the huge amounts of data that have to be sifted, identifying risks in the company to be taken over is the key success factor:

e.g

The complexity of due diligence fundamentally requires a very well-planned approach. We at IQX have a very detailed “Due Diligence Criteria Catalog” to cover all questions that need to be clarified in the various specialist areas.

Development of financing options: Development of financing scenarios on how the acquisition should be financed, be it through cash reserves, debt, equity or a combination of both.

Deal structure: Develop proposals for the structure of the deal, e.g. B. an asset purchase, a stock purchase or a merger.

Antitrust and Regulatory Clearance: Assist in ensuring compliance with antitrust laws and any other necessary regulatory approvals.

Financial and operational integration after acquiring a company can pose massive challenges. Differences in financial reporting, IT systems and operational processes can lead to long-term delays in collaboration and massively slow down the realization of synergies.

It is therefore essential for the IQX GROUP to develop a detailed integration plan as part of the due diligence that focuses on the harmonization of financial systems, IT infrastructure and operating processes.

Corresponding expected costs must be included in the overall assessment of the purchase price.

The uncertainty and changes during a merger can cause anxiety among employees - this can lead to reduced productivity and high turnover. Therefore, after acquiring the company, it is essential to set up a communication management system that is specifically geared towards integration and that transparently reports to employees about the advantages and effects of the merger.

Realizing expected synergies from the merger, such as cost savings or sales increases, is often more difficult than expected.

As already mentioned above, the development of an exact integration plan during the due diligence is crucial in order to actually achieve the set synergy goals.

This plan must also include the necessary capacities and skills for the integration - experience shows that these are often significantly higher than the costs of actually acquiring the company.

Managing the expectations and concerns of various stakeholders, including shareholders, customers, suppliers and creditors, can be challenging and requires intensive communication during due diligence and integration/merger. The main thing is to build trust and support for the planned deal.

As shown, it is important for acquirers to take a holistic approach and take cultural, financial, operational and regulatory aspects into account at the same time in order to actually manage the complexity of mergers and acquisitions effectively. By addressing these challenges head-on and with strategic foresight, companies can realize the full potential of their mergers and acquisitions.

Read more ... Mergers & Acquisitions

your contact

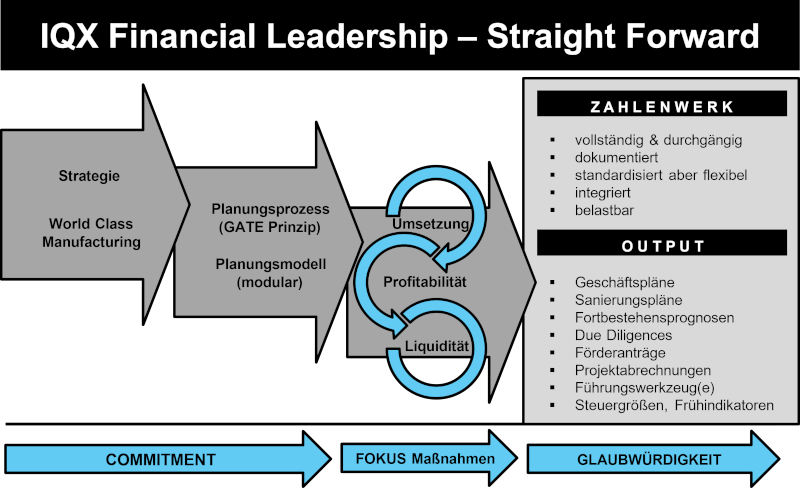

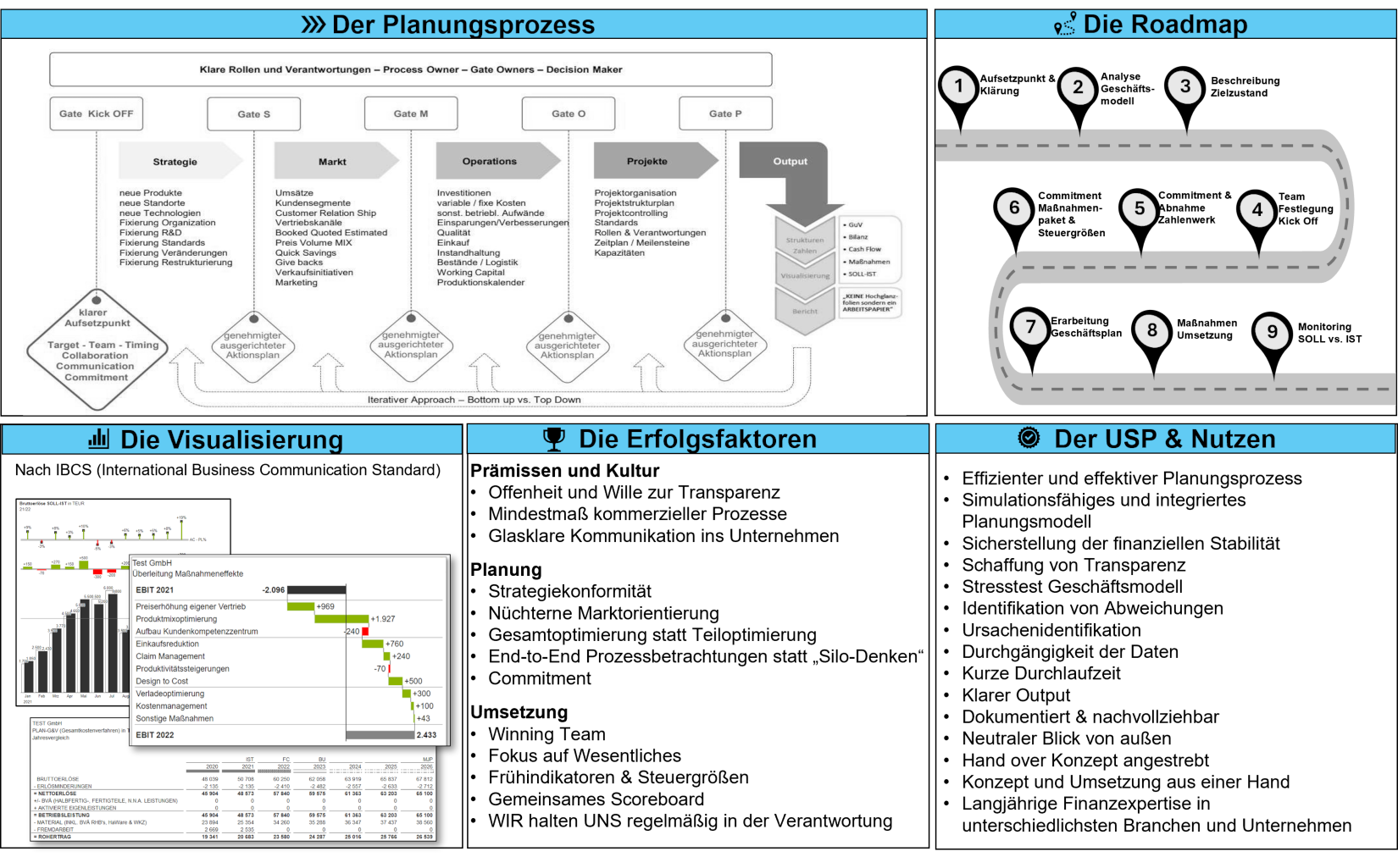

With a fully reliable, strategy-compliant set of figures (planning, reporting, KPIs), synchronized with effective measures, we prepare the foundation for unbeatable transparency. We map your company's business model at its core and ensure that the key success levers are identified and tracked.

Transparency across the entire company and a full focus on effective implementation are our top priorities.

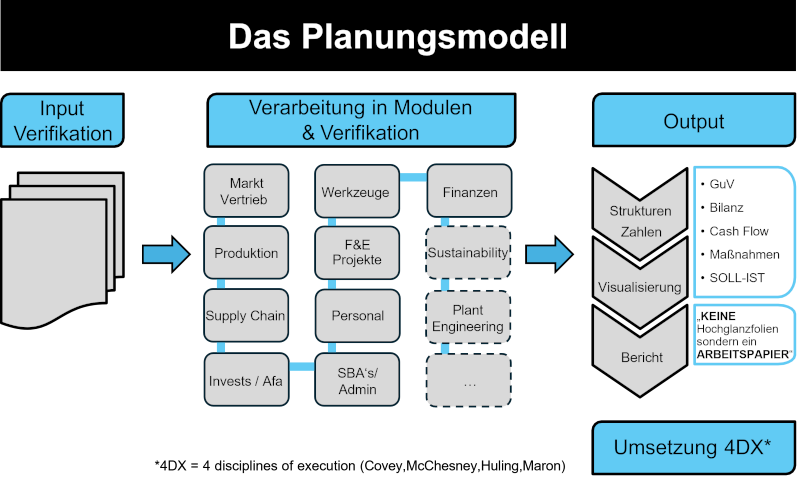

Together with your key players, we commit to a planning process that determines all the required results in terms of timing and quality (according to the GATE philosophy) and ensures their effectiveness using stress tests. Built on our planning model, designed as a constantly learning system, maximally flexible and consistent.

With this control instrument we create the clarity that is needed to gain credibility.

Our ambition is to think of your “financial leadership” as best-in-class and, together with you, to align your company “straight forward” for a sustainably successful future.

The associated change is often perceived by the organization as a stressful challenge. Operationally fully integrated, from the start of the project to the end of the project, we see it as our task to provide hands-on support during this change process, to conceptualize, decide, implement the future path together with you and your key players and its sustainable, successful use through intensive sparring.

We act from a factual, sober, neutral position. However, they require a high level of discipline AND commitment.

Deviations must be identified as early as possible. If the numbers are not correct, the task is to find out the true causes and to take or demand countermeasures immediately. The focus is always on action.

The objective is to ensure the financial stability of a company. The IQX Group has restructured a number of companies, all of which had a similar pattern in their history. Based on this knowledge, a set of methods was developed which, when used correctly, allows for early detection and prevention of countless unpleasant problem situations.

WHEN WILL WE BE CALLED:

If the numbers are not correct, if you are not satisfied with the transparency, if credibility or the basis of trust suffers, but also if an established set of figures needs to be checked for completeness or expanded, or if there is a fundamental (temporary) need for financial and... Leadership expertise exists.

WHERE IS YOUR BENEFIT:

Read more ... Financial Leadership

+43 664 805 092 100

The global procurement market currently represents a major challenge in terms of availability, price and deadline pressure for components and services that needs to be solved. With our experienced and competent employees from the areas of purchasing, logistics and supplier quality (SQ), we develop holistic solutions that are implemented in close cooperation with our customers' specialist departments. The sourcing of new suppliers in Eastern and Western Europe, as well as in Asia, as well as the consistent purchasing and quality support right up to the final acceptance are an integrated part of our service. With the help of quality criteria that include the economic, macroeconomic and social conditions, a regional analysis is created, taking into account quantitative criteria such as personnel and logistics costs, to find the optimal supplier.

Read more ... Re-Sourcing Southeast Europe